A Flexible Platform To Get You Started Quickly

The Credit Sense platform includes a range of customer experience, workflow management and data capture solutions, and it’s easy to get up and running quickly.

Customer Experience

Great customer experiences don’t just happen. They require a deep understanding of the problem, continuous consultation with customers, lots of trial and error and a desire to innovate and deliver something special.

Our customer experience solutions reflect our level of commitment to meeting our clients’ integration needs and delivering a customer journey that is second to none.

|

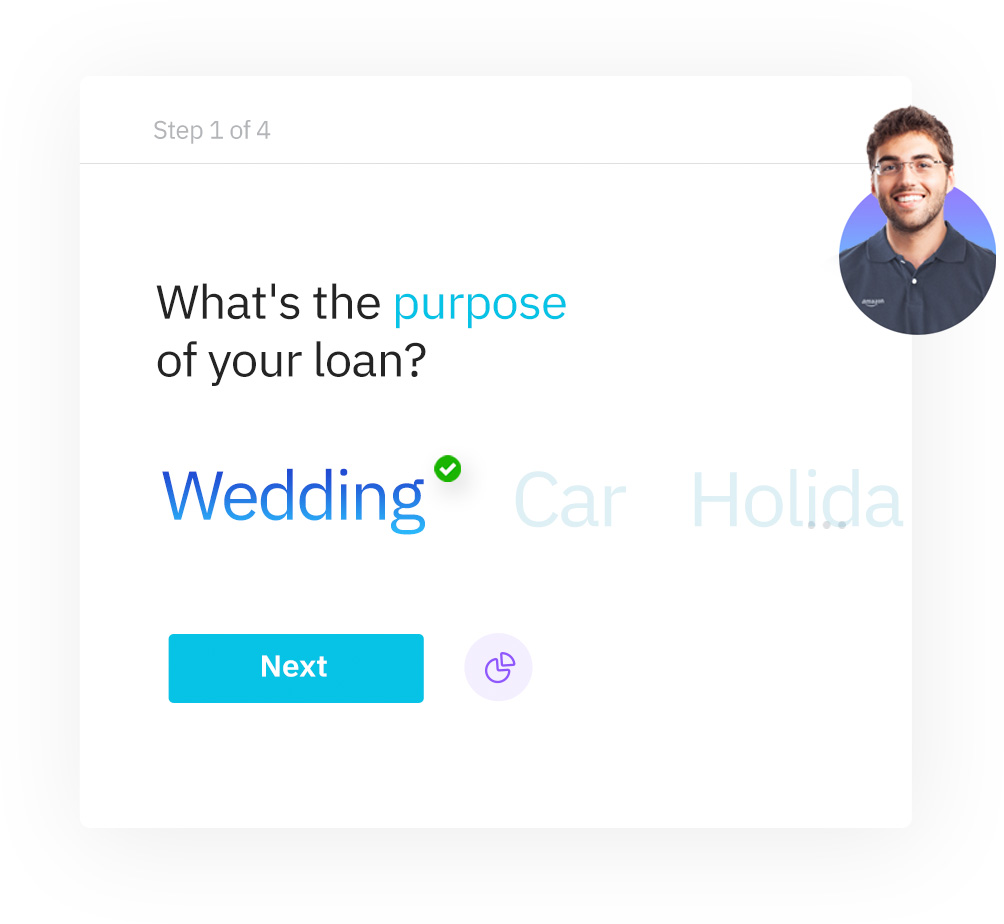

Customer Journey |

Our customer journey is where the customer engages directly with us to provide their consent and access to the data sources that hold the information they wish to share.

The Credit Sense customer journey delivers for customers in terms of security, convenience, visibility and usability, creating a relationship of trust and comfort.

|

Customer Engagement |

You can use Credit Sense to improve customer satisfaction and reduce friction at a number of different customer lifecycle stages, online or in-person.

However you engage with your customers, we have tools to help you professionally and smoothly hand the customer into the customer journey.

Workflow Management

The Credit Sense platform provides a range of workflow management tools to give you visibility, and enable orchestration of everything from customer engagement to data delivery.

|

Client Dashboard |

Our dashboard offers clients immediate, secure access to all of our services – with no integration. Although most clients will integrate the Credit Sense services they use, the ability to also access them from our online dashboard provides flexibility and value for teams dealing with edge cases and the day-to-day needs of their business.

|

Data delivery |

Different businesses have different needs when accessing data and insights customers have shared with them through Credit Sense. We have secure and reliable data delivery options to support use-cases from manual report review, to automating customer flows based on data insights – and everything in between.

Data Capture

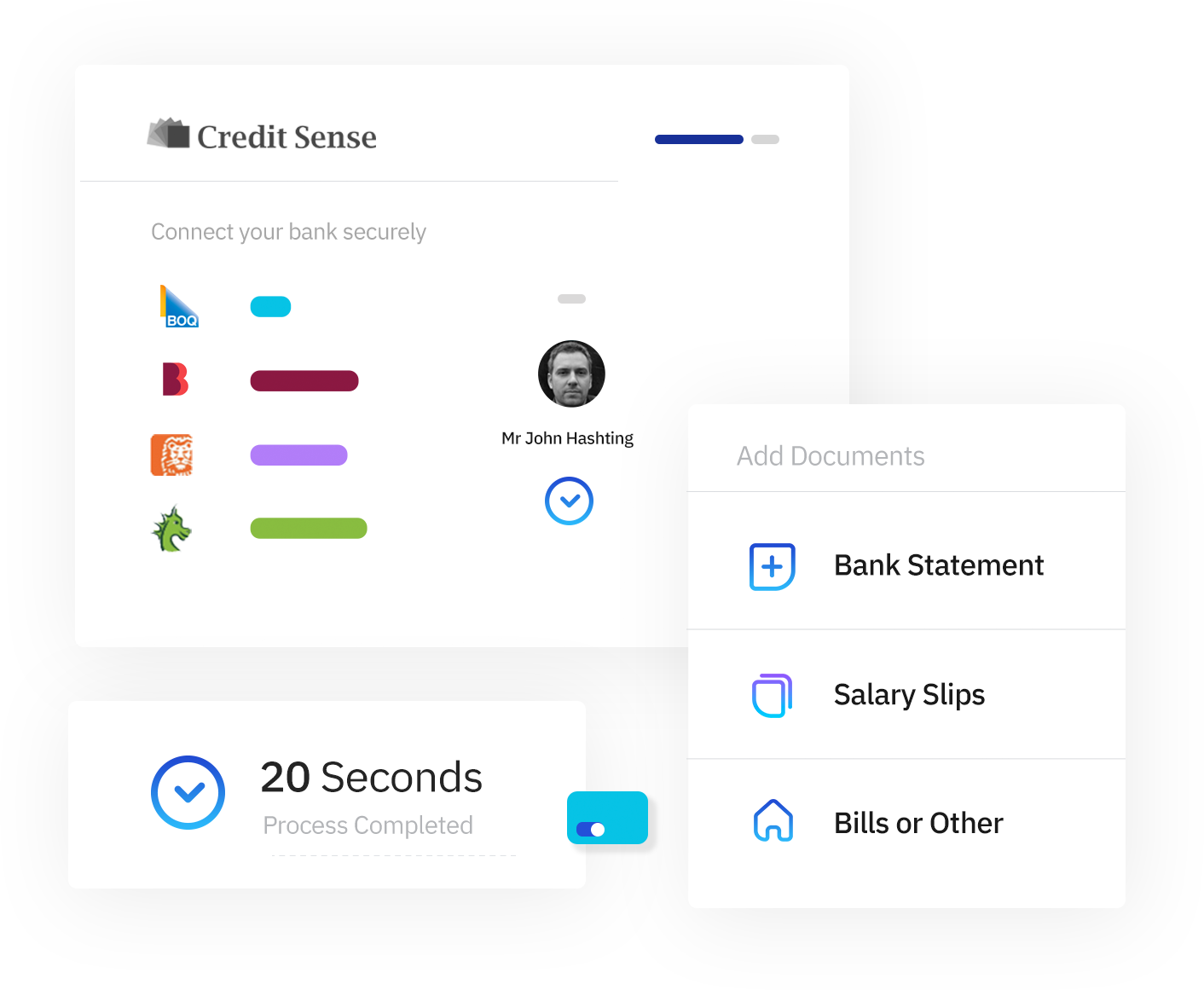

To enable customers to share their data, we first need to capture it. We offer several data capture options designed to support different business use cases.

|

Digital Data Capture (DDC) |

Digital data capture enables fast, consent driven access to bank statement information and other supporting documents. It’s secure, convenient, and helps customers supply verified information about themselves when applying for financial or other products or services that require it.

|

BYO Data |

If you have your customer’s transaction data and authority, our BYO Data service lets you securely transmit it to us and access our Income and Affordability insights.

You can also use our Enrich service to categorise your transaction data and create new value-add services for your customers.

|

PDF Data Extraction |

If your customers supply PDF account statements, PDF Data Extraction can enable automation and make your assessment process faster, without needing to change the way your customers supply their information.

By using PDF Data Extraction you can also access our Income or Affordability insights, and Authenticate, our fraud checking and process improvement product.

Learn More About PDF Data Extraction

|

Ongoing data access |

When you enable your customers to share data with you using Digital Data Capture, with their consent and authority you can access updated transactions for an agreed period of time.

You're in good company

Claim Your Free, No-Obligation

60-Minute Product Demo

Here’s what we’ll go over during your free demo:

Options to increase the speed of your online application process and improve your completion rates

How you can use Credit Sense to automate parts of your online application workflows, risk management and compliance activities

Income identification and affordability assessment solution options for your business

The ‘Plug and Play’ integration model that makes it simple, easy and effective to integrate into any online system

Plus, we’ll cover any technical, security and process related questions about how Credit Sense can work in your business

Fill out the form below and we’ll contact you shortly to organise your free product demo.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.